is property tax included in mortgage ontario

Only the interest portion of the mortgage is deductible and the interest is only deductible in the original term of the loan. 2021 Property Tax Value 3055 2021 Residential Property Tax Rate 0611013 2021 Tax rates for Cities Near Toronto Best 5-Year Variable Mortgage Rates in Canada nesto 180 Get This Rate Butler Mortgage 184 Get This Rate CIBC 259 BMO 265 Promotional Rate RBC 270 TD 270 Get This Rate Fixed Rate Variable Rate.

Should You Pay Property Taxes Through Your Mortgage Loans Canada

Mortgage Interest Deduction Homeowners Biggest Tax Perk Hgtv If the sale of the property is not subject to hst included inin addition to seller agrees to certify on or before closing that the sale of the property is not subject to hst.

. Whichever option you decide upon will be a personal choice that suits your own needs and lifestyle though typically most homeowners will pay their property taxes through their mortgage as the pros tend to outweigh the cons. MCAP will collect a set amount along with your regular mortgage payment. If your property is not located within a municipality contact the Provincial Land Tax Office in Thunder Bay for questions about your Provincial Land Tax account s payment s tax certificate s or bill s.

A property tax or millage rate is an ad valorem tax on the value of a property. MCAP will pay your property taxes on time avoiding any possibility of late fees. The tax portion collected is placed in a property tax account which is separate from your mortgage loan.

If you pay your real property taxes by depositing money into an escrow account every month as part of your mortgage payment make sure you dont treat the entire payment as a property tax deduction. On-time payments every time. A mortgage lien is a claim to your property until you make good on your liability in this case property taxes.

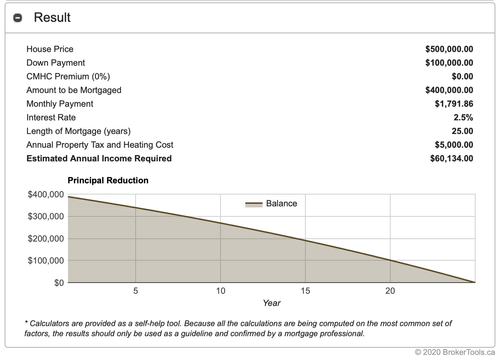

For example if your lender estimates youll pay 2500 in property taxes in a year and you make your mortgage payments monthly your lender will collect an extra 20833 2500 12 20833 each month. Once you receive your 2021 notice you can call 1-877-627-6645 and an agent will help you. The vast majority of homeowners pay property taxes in monthly installments to their mortgage lenders who make the requisite tax payments to the county.

If a homeowner is forced into foreclosure his lender will likely have to pay the remaining property tax amount. In comparison a similarly-priced home in Windsor which has the highest tax rate of 1818668 would have a tax bill of 909334. The first 2022 OEPTC payment is scheduled to be issued on July 8 2022.

That means youd be looking at a 2000 property tax bill. So they are separate completely. Every month you pay a portion of your property taxes on top of your monthly mortgage payment and your lender usually saves up those payments in a separate account called an escrow.

However its important to note that a. Property tax included in mortgage payment issue. Property taxes like income taxes are nonnegotiable meaning you have to pay them.

Hey all been a while since Ive posted but keep reading and learning. It will collect that amount on top of your monthly mortgage payment. The MCAP Property Tax Service is complimentary for all our mortgage holders.

When a homebuyer includes the property tax with monthly payments it could mean a changing mortgage amount. If they are incurred for the purpose of earning income by renting property to tenants the interest portion of the mortgage is deductible on line 8710 of the T776 Rental Income form. Property tax is a levy based on the assessed value of property.

The mortgage the homebuyer pays one year can increase the following year if property taxes increase. Is Property Tax Included In Mortgage Ontario. For example a Toronto homeowner with a property valued at 500000 would pay 305507 in property taxes based on the citys rate of 0611013 the lowest on the list.

Of your annual estimated property taxes with each regular mortgage payment. Now say your local tax rate is 1 and your homes assessed value last year was 200000. The rates for the municipal portion of the tax are established by each municipality.

If you dont you put yourself at risk of mortgage liens or foreclosure. Dont forget though if you have any questions or would like to make any changes within your current mortgage im always. With tax season around the corner it is a good time to think about collecting any relevant tax documents sent by your mortgage lender so tax can be reported in your Federal income tax return.

A municipal portion and an education portion. Including your property tax payments in your mortgage payments allows your lender to protect himself. Most condo owners pay condo property tax divided into 12 equal parts included in their monthly mortgage payment.

What Im trying to figure out is whether I will actually have taxes due in cash on closing or whether the remaining tax amount the HST charged less the rebate will be included in my mortgage. One less bill to worry about. I understand from this thread that the calculation goes like this assuming this is.

While your local government charges property taxes every year you can pay them as part of your monthly mortgage payment. Property tax has two components. No theyre not because property taxes are charged from the municipality in which you live.

And 000100 your condo fees are paid to the management company. If you dont pay your taxes the county can put a lien on your property. Are property taxes included with my condo fees.

I am eligible for the 2022 OEPTC payments but I forgot to apply for them when I. Lenders commonly require this if. Essentially we help you save enough money so that we can pay your Nproperty taxes in full when they are due with money you have accumulated in your property tax.

Paying your property taxes with MCAP. So our mortgage with BMO includes the property tax component approx 95biweekly payment and this has recently changed to 185bi-weekly payment because its not enough to cover the property tax on the property. The inclusion of property taxes in mortgage payments can make for a higher closing cost when going through escrow.

Thats why failing to pay property taxes is considered an event of default allowing your lender to foreclose on your property. Generally only the amount that the bank or lender reports to the Internal Revenue Service IRS often noted on Form 1098 qualifies for the deduction. In a two-tiered municipality a component of the rate is set by the upper-tier and a component is set by the lower.

Online Mortgage Calculator What Is My Mortgage Payment Calculator Valoan Vam Monthly Mortgage Mortgage Payment Calculator Online Mortgage Mortgage Payment

Mortgage Document Checklist What You Need Before Applying For A Mortgage

Should You Pay Property Taxes Through Your Mortgage Ratehub Ca

Do I Have To Pay Property Taxes Through My Mortgage Ratesdotca

Richmond Hill Property Tax 2021 Calculator Rates Wowa Ca

6 Helpful Tips For Mortgage Shopping Helpful Hints Mortgage Mortgage Brokers

Latest Latest Business News Mortgage Applications Drop With Rates At Two Year High Real Estate Rentals Commercial Real Estate Real Estate Marketing

Claiming Expenses On Rental Properties 2022 Turbotax Canada Tips

Paying Property Taxes Avoid A Big Bill Options To Make It Easier My Money Coach

7 Questions To Ask Your Mortgage Lender First Home Buyer Buying First Home Home Mortgage

Should You Pay Property Taxes Through Your Mortgage Loans Canada

Should You Pay Property Taxes Through Your Mortgage Loans Canada

Once We Can Prove You Ve Received A Similar Level Of Overtime Over The Last 2 Years We Can Then Use That To Add To You Mortgage Tips Financial Services Lenders

Buying An Investment Property For Student Rentals In Ontario Mortgage Broker Life Insurance Wealthtrack